Jean Staig

Discovery for Visa: A New Approach for P2P Transfers

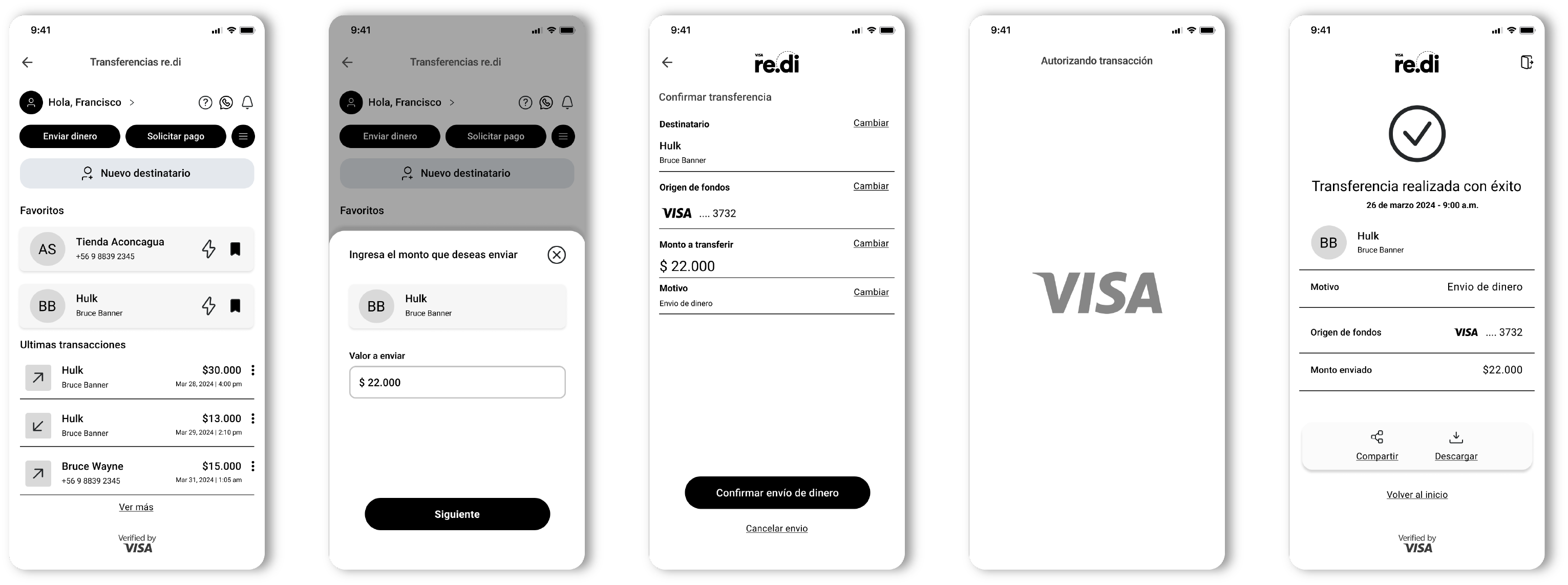

I led the experience exploration and design for "re.di," a proposed modular SDK (B2B2C) by Visa to enable fast, low-friction P2P (Person-to-Person) transfers for its banking partners in Chile. The core challenge was to condense transactional complexity and regulatory requirements into an intuitive, rapid, and easily integrable UX within existing bank applications. The key deliverable was a set of low-fidelity wireframes that served as a strategic product proposal and flow architecture blueprint.

The Challenge and Strategic Context

The Chilean payment market was evolving rapidly, and the need for instant, frictionless P2P transfers was critical for banks to maintain relevance against fintech competitors. Visa aimed to position its existing technology (under the new product, re.di) as the enabling solution for this space.

- Strategic challenge

- Local adaptation: The global Visa product had to comply with Chilean regulations and local payment habits, respecting the technical constraints of partner banks.

- Invisible complexity: The backend flow had to manage the complexity of security, reconciliation, and Visa network transactional rules.

- Design challenge (UX/Service)

- Speed and simplicity: Designing a hyper-fast P2P flow that minimized steps, especially after being challenged to further reduce friction post-initial delivery.

- Creating an intuitive experience where system security and robustness were transparent to the user.

- Enabler role (SDK)

- The experience was not for a direct Visa end-user, but to be implemented by the bank's interface (the SDK). It needed to be modular and easy to integrate.

- My work had to serve as a technical and business guide for the banks' development and product teams.

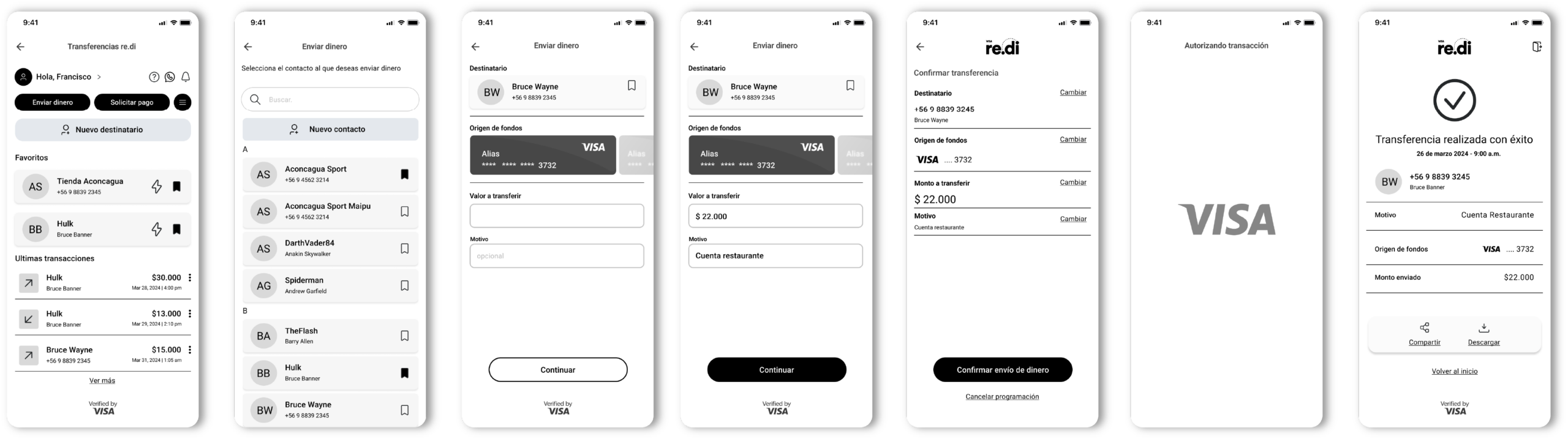

* Pay-a-contact flow

My Role and Leadership

My role: Service designer and UX designer.

My Key accountability: Serving as the sole designer and the design point-of-contact in Chile. I led the definition of the user experience, translated product requirements into design flows, and acted as the leader of the experience discussion with the client (Visa).

Collaboration: I worked directly with a Product Manager (PM), ensuring design decisions were always aligned with business objectives and the technical feasibility of the SDK.

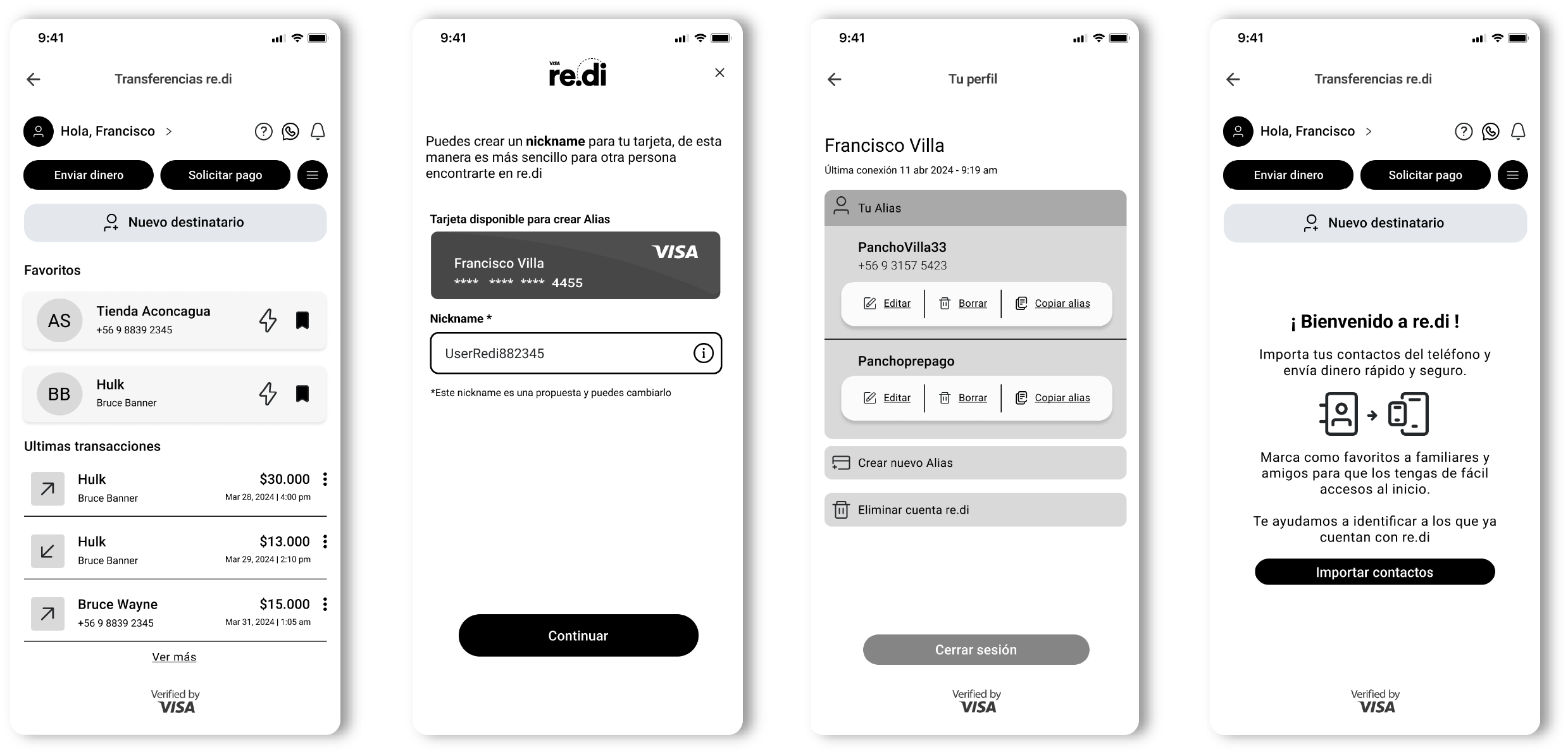

* In-App bank onboarding

Discovery Process and Rapid Design

The project was tackled with an intensive Discovery and flow design approach:

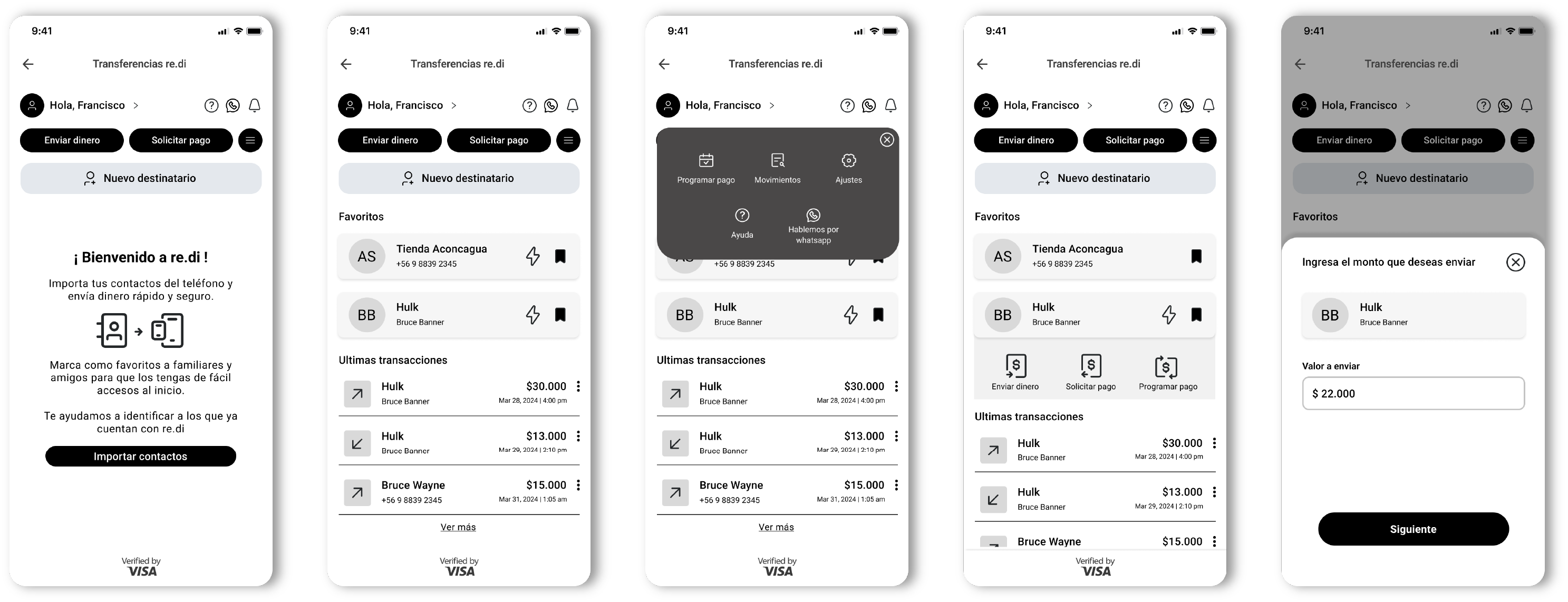

- Audit and market analysis: First, we studied the existing Visa P2P product and its architecture. Simultaneously, I analyzed Chilean competitors to establish benchmarks for speed and local user expectations.

- Flow mapping (service design): Together with the PM, we defined the key user scenarios (first-time use, recurring transfers, error handling). Mapping the complete service allowed us to understand where the SDK (re.di) fit into the broader banking journey.

- Ideation and low-fidelity prototyping:

- I generated the first iterations of wireframes, focusing on transactional legibility and friction reduction.

- Iteration by challenge: After the initial review, the client challenged the solution to be even faster. My response was to simplify the action hierarchy and seek smarter data entry methods (e.g., contextual recognition or pre-selections).

- Delivery as architecture blueprint: The low-fidelity wireframes were delivered as a strategic document that showed not just the what (the interface) but the how (the flow logic and conditional decisions). This provided a common foundation for the bank and Visa development teams during implementation.

* Home screen variations

The Solution (Hyper-optimized flows)

The resulting design proposal for the SDK prioritized speed over visual exhaustiveness, focusing entirely on the task.

- Step minimization: The transfer flow was successfully reduced to the essentials (e.g., Contact → Amount → Confirmation), using default settings and smart inputs to accelerate decision-making.

- Modular design: Being an SDK, the wireframes were designed as functional blocks that the bank could re-style and insert into their native look and feel.

- Intelligent error flows: Error messages and recovery paths were designed to be informative but non-obstructive, maintaining the perception of Visa's reliability.

* Quick Send Money Flow

Impact and product learnings

- Offshore design leadership: Being the sole designer in the region required me to lead the client conversation, translating business needs into design requirements, and defending UX decisions based on the local context.

- B2B2C design: This project was crucial for understanding how to design an enabling product (SDK). UX quality is measured not just by the final user interaction, but by the ease of integration for the partners (the banks) and the value it delivers to satisfy their customers.

- The value of strategic low fidelity: Delivering low-fidelity wireframes was a strategic win. It allowed for rapid validation of the flow architecture without getting bogged down in premature UI discussions, keeping the focus on logic and transactional speed, which were the true product KPIs.